Interested In Free Insight To Health Insurance?

Check Out Our Catalogue Of Insight Articles!

We're constantly putting out more and more information about health insurance so that anyone who might be in need of coverage can enter the conversation better informed. Getting the coverage that you actually need is always easier when you know what you're walking in to.

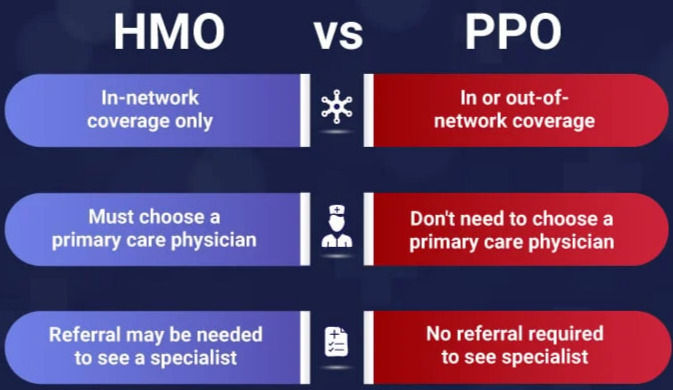

HMO VS. PPO

Having the ability to be seen by your preferred medical provider vs. being told which doctors you're allowed to visit is something that you need to be aware of when comparing health insurance policies/providers. We pride ourselves in our advanced & extensive network of PPO policy providers which allow us to grant access to the largest network of medical providers in the country who will accept PPO policies! Our clients get to enjoy the widest range of available options when it comes to being seen and accepted by medical practitioners all over the country.

Affordability

No matter how great the coverage on a policy is, if you can't afford to keep it in place, then you're just throwing money away. As advisors, it's our duty to ensure that when we build a plan for you, it is built to fit your specific needs (which includes staying within your budget) so that you have a quality & reliable policy that you know will be there when you need it most! If your financial situation has taken a turn, simply let us know. We can build a simple policy to get you basic coverage and simply upgrade for additional benefits at a later date when things are going your way.

Benefits

Not all policies are created equal! While many health insurance policies claim to bring you a whole list of benefits, they often have tricky stipulations hidden in the fine print and loopholes that can prevent coverage activation for the policy holder. Each and every policy written, brokered, or created by us will not only come with benefits that are easy to understand. But also prior to activation of your custom built policy, we will conduct a screen share presentation and go over the benefits in a simple and straightforward manner!